Opinion:Making Sense of the Dollar and Yuan

Filed under:Analysis, economy, General, Opinion | Tags:global financial crisis, global recession, obama visit, renmingbi, yuan peg

Add comments

Yet despite the goodwill generated by the trip, there is one sharp difference that festers between the two – and that is the value of the Yuan. Many in America feel that the Yuan is not only undervalued, but has created a huge trade deficit, setting in motion the current global financial crisis and threatening to prolong the current U.S. recession.

Many in China feel that the U.S. is unfairly sending China out to be a sacrificial lamb. The world recession (of which the U.S. recession is a part) was caused by the financial crisis, which originated in the U.S. as a result of U.S. mismanagement of its capital market. Economic prosperity is not a zero-sum game. The U.S. needs to focus on fiscal responsibility and revitalizing its unhealthy financial industry instead of blaming on China for its own problems.

The issue of trade between the U.S. – the biggest economy in the world – and China – soon to be the second largest economy in the world – is very important. The prosperity and stability of the entire world depends on a healthy, sustainable trade relationship between the two economies. So here are some topics for discussion:

- What caused the trade imbalance between the U.S. and China?

- Did the trade imbalance between U.S. and China cause the financial crisis?

- Is the Yuan costing U.S. jobs?

- Why doesn’t the Chinese government allow the RMB to float?

- Would an upward revaluation of the Yuan be good for the U.S. economy?

1. What caused the trade imbalance between the U.S. and China?

This is a complicated question. From a macro-economic standpoint, bilateral trade deficit can arise between two economies only when there is a difference in the savings / investment rates between the countries. The Yuan peg did not create the trade imbalance. The trade deficit between U.S. and China is a natural consequence of the difference in savings and investment rates between the two economies.

But what does this actually mean?

It means that part of the deficit reflects merely the opportunities – both in terms of labor supply and end market – that China presents to U.S. companies. When a company like GE or GM decides to build a factory in China to take advantage of China’s abundant labor supply or to invest in China to develop stake their claims to China’s rapidly wealthy consumers, these companies move capital into China. That capital flow into China will add to China’s balance of account with the U.S. – even though this is still asset under the control of American companies. Every dollar that is converted to Yuans will end up adding one more dollar to China’s holding of the dollar reserve even though every one of these dollars (plus more if these companies make money in China) can be withdrawn to the benefit of American companies in the future. Part of the deficit therefore simply reflects the rush of American companies to China to finally service those famed 1 billion+ Chinese consumers.

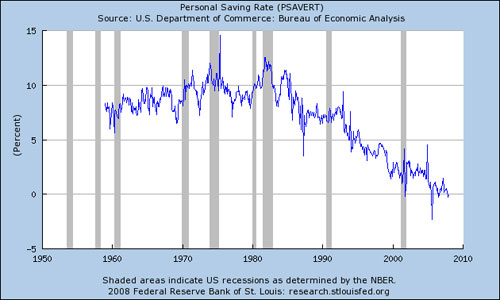

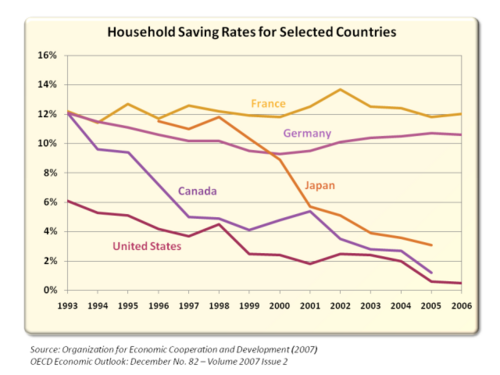

Another part of the deficit reflects the difference in aggregate savings rates (household + government) between U.S. and China. The following charts shows a long but steady decline in U.S. personal savings over the last three decades.

src: http://seekingalpha.com/article/112604-what-will-happen-if-america-returns-to-an-historical-savings-rate

As can be seen, the personal savings rate decreased from over 12% in the mid 1980’s to almost zero in 2008 (in 2009, Americans personal savings rate shot up, but that was mostly offset by the dramatic increase in Federal government deficits). At the same time, the U.S. Federal government deficit has also steadily increased.

src: http://zfacts.com/p/318.html

The net result is a progressively widening of the U.S. balance of trade with the world over the last three decades.

src: http://www.census.gov/foreign-trade/balance/c5700.html

src: http://www.census.gov/foreign-trade/statistics/historical/gands.txt

It’s amazing to see the close correlation between America’s trade deficit and its drop in aggregate savings rate – though it is not difficult to explain. When Americans spend more than they make, and when others save more than they make, the net result of trade between the U.S. and others will favor others on the whole holding more dollars than before.

Some might say this is all China’s fault. China artificially depresses its currency and runs up huge foreign reserves to addict the U.S. to cheap products and cheap credit. But the fact is that China did not always have a cheap currency. During the Asian Financial Crisis for example, China was actually lauded for keeping the value of its currency high while the rest of the currencies in Asia went into a nose dive. Yet throughout that time, the overall U.S. trade deficit continued to grow. China also did not always have a huge dollar reserve to “addict” the U.S. government with cheap loans. The U.S. government deficit has actually grown steadily since the 1980’s, long before China started lending massive amounts of money to the U.S. Even today, China holds only about 6.7% (about $800 billion) of the total U.S. debt of $12 trillion. It is disingenuous to hold China responsible for U.S. government’s spending habits.

Before accusing China too much, we need to understand that the U.S. currency imbalance is a direct symptom of the U.S. living above its means. The U.S. currency imbalance is a global phenomenon it has with the whole world, not just with China. The following chart shows the % of annual deficit the U.S. has with China versus the the world, starting 1985.

As can be seen, the percentage of U.S.’s trade deficit with China has bounced back and forth around 35% of its overall deficit for much of that last two decades. Whatever issues the U.S. has with China, it also seems to have similar problems with the rest of the world.

2. Did the trade imbalance between U.S. and China cause the financial crisis?

I tried to answer this question in a recent post here on Foolsmountain. I still stand by what I said. The financial crisis was a recent phenomenon caused by a mixture of questionable U.S. domestic policies on housing throughout the 2000’s, the easy money supply the Fed fomented in the aftermath of September 11, and an under-regulated U.S. financial market that fed on the previous two to create a major housing bubble. The financial meltdown in the U.S. exported a financial crisis, and then a recession, to the rest of the world. The current problem in the U.S. financial industry is a separate and distinct issue from the more long-term issue regarding the balance of account (savings / investment) that the U.S. has had with the rest of the world for much of the last three decades.

3. Is the yuan costing U.S. jobs?

In some ways, I suppose the yuan (or the rupeee, or the peso) does cost U.S. jobs. Due to the low costs of doing business abroad, the U.S. no longer has a major textile industry; much of the call center business has been outsourced to India; major electronic fabrication facilities now resides in Asia rather than in America.

But on the other hand, the loss in jobs is supplemented by opportunities in other fields. With the advent of the industrial and later information age, many traditional jobs also disappeared. Yet, for society at large, the benefit of the transformation outweighed the bad. Society became more productive; people’s standard of living increased. The same can be true of globalization.

America has the best scientists and most innovative engineers, the hippest designers, the most advanced high-tech industries, and most developed expertise in law, medicine, finances (the financial crisis not withstanding). Outsourcing lower-value work to developing countries while re-deploying its resources to higher value ones is not a bad deal for America.

But doesn’t an artificially weak yuan steal jobs from the U.S.?

I don’t think so. The economies of China and U.S. are surprisingly complementary. Few companies directly compete with each other. When the yuan is weak, China will have to ship more t-shirts, toys, computers, cameras, etc. to the U.S. to buy each Boeing airplane or hire each architecture team to design one of its sky scrapers. China’s cheap labor is an asset, not a liability, to the U.S. Stalwart companies like Boeing and GE become more competitive by procuring parts from all over the world, including components from China, instead of buying only American. American workers benefit when the U.S. imports from China, and their daily cost of living is reduced. The question forward should not be whether China is an asset or liability to America, or even how to model the American economy to be more like China’s, but how to leverage the unique strengths of America to create a better future for America.

4. Why doesn’t the Chinese government allow the RMB to float?

I believe over the long term, the Chinese government will work to allow the RMB to float. Currently the Chinese financial institutions are still at an infantile state of development. There is still wide-spread resistance against making the RMB freely floating and be subject to currency speculations such as those that brought down so many currencies in the Asian Financial Crisis.

China is also concerned that a sudden increase in the RMB will kill its economic recovery. 7.8% of its economy by GDP is involved in the export business (according to this summary in the wikipedia, exports of goods/services accounts for 39.7% of gdp, imports of goods/services accounts for -31.9% of gdp). Even if raising the RMB might be good for its overall economy (especially as it scours the world for resources and assets to purchase), China cannot risk placing its export industry in jeopardy.

[NOTE: the 7.8% figure I derived above may not be quite correct. If all of China’s import goes to making exports, then 7.8% would be right (39.7% – 31.9%). However since China also imports for its own consumption, not all of the 31.9% it imports goes into making export and hence 31.9% is too high a figure to subtract from 39.7%. I remember reading somewhere that some 20% of China’s GDP is involved in export, but I can’t find the source of the info now.]

As China works to decrease its dependence on exports, it will eventually find it politically unpalatable not to allow the RMB to float. There are so many benefits – including making the RMB one of the reserve currencies of the world. But before that is to happen, China will first have to beef up its financial industry. Perhaps starting as soon as next year, we will see the RMB begin to appreciate steadily and gradually. Whether that will actually reduce America’s currency imbalance depends however on a number of other factors – including whether the U.S. reduces its aggregate debt and opens up its economy for Chinese companies to invest (allowing for capital to flow back to the U.S.).

5. Would an upward revaluation of the Yuan help to lift the U.S. economy out of the current recession?

I don’t think so. Does the U.S. expect to export more products to China with a stronger Yuan? Does Boeing, for example, expect to sell more planes to China if the RMB appreciates? I haven’t read about reports of China not buying from America because it has run out of money.

Even if a revaluation does stimulate the flow goods and services from certain sectors of the U.S. economy to China, a revaluation would not necessarily be good for the overall American economy. A wide range of goods and services imported from China on which businesses and consumers depend in the U.S. will all of a sudden become more expensive. Whether these will in the aggregate serve to stimulate or choke off growth for the U.S. economy is hard to tell.

Personally, I don’t think the main impediment to the recovery of U.S. economy is China or the Yuan. The most important intermediate-term issue is to clean up America’s financial health. Too many banks still hold bad assets on their books. Too many houses are still too bloated in value. The result is that banks become too afraid to lend, and consumers become too meek to spend. The government now steps in with a stimulus package, but unless that leads to economic growth, it will only wrack up more debt, which does not portend well for the future. Unless America’s financial system is cleared (it won’t be easy, but it must be done), the U.S. economy can’t truly recover.

In the longer term, the U.S. must re-learn to spend less and save more. The U.S. was able to prosper going into debt for so long because of the incredible faith the world placed in the U.S. economy, the status of the dollar as the world’s reserve currency, and the many innovations the U.S. made in its financial market (the current crisis not withstanding) to allow its economy to more efficiently allocate capital. However, the massive currency imbalance it incurred with the rest of the world will not be sustainable indefinitely. In the future, the U.S. must again learn to live within means – to balance the government budgets and increase the personal savings rate.

The U.S. is still by far the biggest, and the most dynamic economy in the world. Its creation of and participation in the global market has brought it – and the rest of the world – amazing wealth. Globalization is not dead. There is much work to do, but the future should be – has to be – bright.

There are currently 1 comments highlighted: 54150.

November 26th, 2009 at 5:48 am

Allen, it looks like the Chinese government might strengthen the yuan per this article in today’s China Daily. Here are a few excerpts:

“The vice-foreign minister said the RMB rate’s flexibility may widen, echoing the nation’s central bank a month ago.

“The announcement by Vice-Foreign Minister Zhang Zhijun comes after the People’s Bank of China, which has the power to oversee the yuan and financial institutions, said it was in the process of reforming the exchange rate system.

“China will increase the flexibility of the RMB exchange rate at a controllable level in the future,” Zhang said, “based on the market demand and with reference to a basket of currencies.”

“But he said, China will further work on the exchange rate policy on its own initiative and in a constructive and controllable manner.”

November 26th, 2009 at 6:22 am

@Steve #1,

We’ll see where this leads. China was obviously not comfortable enough stating anything about the RMB in its joint statement with the U.S. I hope that both sides appreciate the predicament of each other side. Obviously everyone wants to recover from the recession as soon as possible. To the extent that I am wrong and that the Yuan peg is truly advancing China’s economy at the expense of the U.S. economy as some people claims, to the extent that the global economic growth is a zero sum game, it is to the benefit of everyone involved to find an “equitable” distribution of growth that all sides can live with.

November 26th, 2009 at 6:30 am

By the way – forgot to mention in my post –

888 888 888 888 888 888 8888888888 8888b. 88888b. 88888b. 888 888 888 888 "88b 888 "88b 888 "88b 888 888 888 888 .d888888 888 888 888 888 888 888 888 888 888 888 888 d88P 888 d88P Y88b 888 888 888 "Y888888 88888P" 88888P" "Y88888 888 888 888 888 888 Y8b d88P 888 888 "Y88P" 88888888888 888 888 d8b d8b 888 888 888 Y8P Y8P 888 888 888 888 88888b. 8888b. 88888b. 888 888 .d8888b .d88b. 888 888 888 888 88888b. .d88b. .d8888b 888 888 "88b "88b 888 "88b 888 .88P 88K d88P"88b 888 888 888 888 888 "88b d88P"88b 88K 888 888 888 .d888888 888 888 888888K "Y8888b. 888 888 888 Y88 88P 888 888 888 888 888 "Y8888b. 888 888 888 888 888 888 888 888 "88b X88 Y88b 888 888 Y8bd8P 888 888 888 Y88b 888 X88 888 888 888 "Y888888 888 888 888 888 88888P' "Y88888 888 Y88P 888 888 888 "Y88888 88888P' 888 888 Y8b d88P Y8b d88P "Y88P" "Y88P" 8888888888 888 888 888 888 888 8888888 888 888 .d88b. 888d888 888 888 .d88b. 88888b. .d88b. 888 888 888 888 d8P Y8b 888P" 888 888 d88""88b 888 "88b d8P Y8b 888 888 Y88 88P 88888888 888 888 888 888 888 888 888 88888888 Y8P 888 Y8bd8P Y8b. 888 Y88b 888 Y88..88P 888 888 Y8b. " 8888888888 Y88P "Y8888 888 "Y88888 "Y88P" 888 888 "Y8888 888 888 Y8b d88P "Y88P"November 26th, 2009 at 6:49 am

@ Allen #2: I don’t think it was a matter of China being uncomfortable, but it was unacceptable to China (and rightfully so) to create the impression that she was capitulating to an American demand during Obama’s visit. In my opinion, this is a good example of the validity of “quiet diplomacy” as practiced by Obama as compared to what many pundits recommended, the “punching the Chinese leaders in the nose” style of diplomacy.

I believe the Chinese government intended to strengthen the yuan even before Obama’s visit to encourage domestic spending and grow the economy, but wanted to wait until after the meeting so they could better manage expectations and show they are in control of their own currency.

November 26th, 2009 at 7:54 am

@Steve #4,

Hmmm … you may be right. I definitely believe quiet diplomacy works also. We need a spy in the diplomatic channel (on both sides) to reveal to us in timely fashions juicy bits so we can discuss here … secretly in the open! 😉

November 26th, 2009 at 8:09 am

Can’t anyone realize that china is in an undeclared war with the US? Not many Americans have read Sun Tzu’s “Art of War” but I’m one who has along with most educated Chinese. The book is classic literature over there. The number one strategy, the preferred strategy in the “Art of War” is to destroy your enemies by ruining them economically. In the past this book was required reading by Korean solders, I would not be surprised to find out the book is required reading in all Chinese schools. Another thing the book explains is how to use spies, seven kinds of spies are explained. To actually fight is something that Sun Tzu discouraged. That is until you enemy has been so weakened that you can massacre them easily. The best way to ensure long term peace is to eliminate trade deficits, read the book. If China sought balanced trade then according to the book we would be allies. Ask yourself the question is China a friend or foe? If China seeks balanced trade then they are our allies, if not we are at war. If we are Joe couch potato does not even know it, could somebody answer the question for Joe so he can have an opinion and make him pass the cheese puffs.

November 26th, 2009 at 8:41 am

November 26th, 2009 at 11:52 am

I will respond to the accusation of paranoid nonsense. None of what I have written would make any sense if an in-balance of trade were not having severe adverse affects on America. Almost anything not made from paper bought in America seems to come from china. Consequently we are all becoming unemployed, our society is eroding and we are being destroyed. Balanced trade is a recipe for sustainability and peace.

November 26th, 2009 at 12:29 pm

Allen

While some have criticized the trip for producing little in terms of specifics

Given that Obama gave great face to the Chinese government by visiting China within his first year of taking office and played by the rules they set, rather than insisting more flexibility, it is fair to say that he didn’t get much in way of return.

one should not casually dismiss the achievements actually made

I’ve read the statement but can’t actually see real achievements. Without repeating the statement can you tell me what is now going to happen that wasn’t going to happen before and what concrete steps have been established to ensure that it happens? As far as I can see the joint statement is just a flowery document that says the US and China will be nice to each other/work together.

The world recession (of which the U.S. recession is a part) was caused by the financial crisis, which originated in the U.S. as a result of U.S. mismanagement of its capital market.

Is this your opinion or just that of some Chinese people?

I believe over the long term, the Chinese government will work to allow the RMB to float

It seems that the Chinese government will only ever make concessions over the long-term. How long is “long” – in 50 years’ time? Be honest, Allen, I think you’re saying that China won’t allow its currency to float for the foreseeable future.

Would an upward revaluation of the Yuan help to lift the U.S. economy out of the current recession?

That is not the question you should be asking. You should ask:

Would an upward revaluation of the Yuan help rebalance the global economy and help prevent another economic crisis of the sort we saw recently?

That is by far the more important question.

November 26th, 2009 at 12:31 pm

“The reason wise leaders of old had no opponents was that they used their opponents to oppose opponents. Only the most humane people in the world can use their opponents to oppose opponents: For this reason opponents did not oppose them, and everyone capitulated.”

Sun Tzu

November 26th, 2009 at 2:43 pm

good article!

@Keith Hayes quote SunTzu is a bit too far, to call imbalance trade a war, as if there is some chinese master mind who has planned this trade war with the states. Who can he/she be? isn’t that too complicated to be planned and implemented for Chinese leadership?

November 26th, 2009 at 10:28 pm

Who said a master mind is behind it, not me. What matters is the effect not the cause. I simply say cultural values need to be examined. The Chinese men I know read Chinese classic literature, its normal for them. Paranoia will annoy ya but the unemployment rate is real.

November 27th, 2009 at 1:02 pm

as I understand, Sun Tzu is all about war as some deliberate and planned undertaking, while how much of the sino-us trade imbalance is the result of deliberate intentions of a single person or a group of persons?

November 27th, 2009 at 3:25 pm

@ Keith Hayes #6: Keith, I’m not sure where you’re going with this. The Art of War is on every military academy and war college curriculum and Sun Tzu is one of the two most studied “classic” authors, along with von Clausewitz. Any businessman worth his salt that is doing business in China has read it, along with Romance of the Three Kingdoms and Water Margin. There are also non-fiction accounts of Zhuge Liang’s tactics that are worth reading.

In Japan, it’s also a good idea to read Musashi’s Book of Five Rings and Frederick Lanchester’s Powers Laws, both commonly used in business there. Personally, I’m a big fan of Lanchester’s Power Laws (originally derived in WW1 from studies of aerial combat) as they apply to market share. I’ve found them to be very accurate in my own experience and would suggest them to anyone doing business anywhere in the world. I’m not as impressed with Musashi but it helped me get a better understanding of the Japanese business mindset back in the ’80s.

When Sean Connery is quoting passages in a Hollywood movie by the same name and amazon.com has four pages of available book versions listed, it isn’t exactly a secret anymore.

November 27th, 2009 at 5:49 pm

Actually Keith, It’s not about China’s secret war with the U.S., but the U.S.’s secret war with China! Ok – it’s not really war but some sort of aggressive love making – which may seem like a type of war – at least according to this Saturday Night Live skit! (it’s a joke people, don’t take it too seriously)

November 28th, 2009 at 1:47 am

I would like to make a correction to the skit. We do NOT owe China 800 billion dollars; they ONLY own 798.9 billion dollars of our nation debt (http://en.wikipedia.org/wiki/United_States_public_debt.)

One point one billion dollars is a lot of money and it’s important to point out this discrepancy. But really any number, no matter how big is nothing to worry about. Ceding large tracks of American farmland to China would easily settle the debt; perhaps we can start with Kansas. Tax revenues from 20% unemployed (the real number) will be missing from our tax rolls for a while and we have to think of something to save face as we don’t have the money.

Normally war would be the reason land transfers from one country to another disenfranchising a local population. However it has been pointed out to me that since we are NOT at war with China this would be an exception to that rule. Some of the manufacturing jobs lost to China could return and allow us to pay the debt that way but I’m thinking China might prefer buying America to settle the debt.

I found Musashi’s Book of Five Rings to be rather shallow myself.

November 28th, 2009 at 2:34 am

Hi Keith,

if you call that a war, then what was happening 20 years ago when the U.S.S.R collapsed, as it could not keep the economic pace dictated by the U.S.

O.k., it was war and the U.S. won. But now you see the U.S. loosing and you cry foul? I mean, at some point U.S. citizens should reflect on their own situation,- example, they should learn that you can not finance house-buying without money by just buying another house and hope that the increase of value will do the job.

Allen wrote only in one line “subject to currency speculation” – that is not a by-effect. International financial institutions made huge gains before the Euro was introduced, and the RMB is not (yet) as powerful as the U.S. dollar or the Euro. Why should China support this no-added value business?

I believe with Steve #4 that there might be some processes started, probably not as much as Obama wanted (“G2” – China has also some local interests and will not abandon them to favor U.S.) but hopefully enough to avoid another next crisis.

November 28th, 2009 at 2:53 am

resent, it seems the first post went into a WOM.

Allen, I have to add one more on this sentence of yours:

>>America has the best scientists and most innovative engineers, the hippest designers, the most advanced high-tech industries<<

You can find probably the original source in English at Thomson Reuters, here from Daily China "Research Super-Power China"

http://www.dailychina.de/20091107/forschungsgrosmacht-china/

"Im Bereich der Materialwissenschaften, Chemie und Physik stammt bereits die Hälfte aller Publikationen aus China;"

On Material Science, Chemistry and Physics already 50% of the Publications comes from China…

The article ends with a statement saying "good perspectives for researches with knowledge in Chinese".

I would add Bob Dylan's "the times they are a changing".

November 29th, 2009 at 12:07 pm

This is a shockingly good post, Allen. The questions you raise are the ones being talked about by lots of interesting economists, and some of the data you’ve put up is very apposite – though I think some of it actually undermines your general argument a bit, particularly that last graph.

Most of your conclusions seem well within the bounds of economic reality, too. I’m completely unqualified to comment any further than that, but well done for illustrating some of the issues so well.

November 30th, 2009 at 6:35 am

I’m always amazed when an argument defends outsourcing jobs by the claim that a loss in one job category is balanced by gains in other job categories as this article has.

“Outsourcing lower-value work to developing countries while re-deploying its resources to higher value ones is not a bad deal for America.”

In any society not all people can only do every kind of work. Take away manufacturing jobs and people who can only do manufacturing jobs become unemployed. It will not matter if new jobs appear from thin air or not. If the displaced don’t have skills for replacement jobs the newly unemployed can’t fill the new jobs. People with “higher value” skills will be needed from abroad if any magical ‘high value’ jobs actually do appear from thin air or the jobs will go unfilled. Workers displaced by outsourcing remain displaced. There is no mechanism to balance the scales to create jobs which replaces those lost to outsourcing. A job outsourced is a job outsourced and that’s all that happens.

Wishful thinking and a horrible deal for America.

November 30th, 2009 at 7:38 am

@Raj #9,

You wrote:

I can’t believe you are asking this question. It’s the opinion of many people around the world. A casual search on google for cause of global recession will give you the following:

http://www.globalresearch.ca/index.php?context=va&aid=1110

http://www.theindianblogger.com/problems/reasons-for-global-recession-in-plain-simple-english/

http://www.oppapers.com/essays/Causes-Of-Global-Recession/198302

http://topics.nytimes.com/top/reference/timestopics/subjects/c/credit_crisis/index.html

You also wrote:

I challenge anyone here (that means you too Raj) to give a succinct and well-articulated reason how the Chinese have caused the current global crisis of the sort we have seen recently.

Note: this is not aggressive posturing on my part, but an invitation to everyone to speak frankly (but objectively – at least as objectively as possible) on what everyone thinks is really going on in the world.

November 30th, 2009 at 11:56 am

Allen (21)

You need to calm down. I never said it was a minority view, I asked whether it was YOUR view as well or if you were just reiterating the views of others. You started the paragraph with “many in China feel”, without using the word “I”.

Furthermore I never accused the Chinese people of causing any crisis. They do not decide China’s exchange rate – that’s controlled by the government. And I didn’t even accuse the government of causing the global crisis. I suggested that a better question is to ask whether an upward revaluation of the yuan would help rebalance the global economy and in doing so help stave off more economic trouble.

November 30th, 2009 at 12:27 pm

What China wants from the west, the west doesn’t sell. Don’t forget the economic sanction the west put on China 20 years ago, it isn’t over yet. The sanction was intended to make China collapse, but thanks to the efforts by both the government and the people, China instead grows stronger and stronger. I think during the next ten twenty years, we will see an explosive growth of indigenous high-tech and high added-valued products coming from China. These products may not be as good as those from the west, but some definitely will be used as substitutes for western products, which will inevitably cause further trade unbalance. This trend will not reverse unless Yuan gets reevaluated.

November 30th, 2009 at 2:32 pm

“This trend will not reverse unless Yuan gets reevaluated.”

I assume if Yuan is raised sufficiently (say 1-1 vs. USD) China will not be export anything anywhere, but I can’t see mere raise of, let’s say 20% vs USD will result in anything but a global economic shock that plunges it back into deep recession. It has been argued over and over again that the exchange rate can’t be the only or even the main contributor to the trade imbalance and the crisis. For example the willingness of Chinese to work more for less, American to consume more than they have and the distortion of the western financial service industry are probably more fundamental causes of the imbalance and crisis.

RMB will appreciate again, gradually as in 2005-2008. While the other structural problems remain. Just look at the financial industry, it now profits from “high-frequency trading”, can anybody tell me what is the benefit of that to the real economy?

November 30th, 2009 at 6:22 pm

“Many in China feel that the U.S. is unfairly sending China out to be a sacrificial lamb.”

Many are right. The US is only concerned about it’s interests, those of China or any other country be damned. Everything else is just theatrics.

“Actually Keith, It’s not about China’s secret war with the U.S., but the U.S.’s secret war with China!”

Correct. The US has nothing to gain by sharing superpower status with, or even getting eclipsed by, another nation. It will do everything it CAN to stifle China’s rise.

November 30th, 2009 at 6:49 pm

A recent essay by Daniel Gross on Newsweek is an interesting read.

“Karl Who?

China is a Communist country, but I have yet to meet an actual Communist.

On several occasions during my 10 days in China, I’ve been told that there are 70 million members of the Chinese Communist Party. And yet it’s nearly impossible to find an orthodox Marxist in Beijing. When you stand in Tiananmen Square and look toward the Forbidden City, you see a huge portrait of Mao flanked by slogans. The slogans used to say things like “Long Live Marxism-Leninism.” Today, they’re simply nationalistic: “Long Live the People’s Republic of China!” (Click here to follow Daniel Gross).

While class struggle and common ownership of property may have motivated the revolution, Mao’s heirs are more interested in outcomes than process. At least a dozen times, officials and businesspeople have quoted Deng Xiaoping’s line about not caring whether a cat is black and white, as long as it catches the mouse. Chinese structures—whether socioeconomic theories or apartment buildings—don’t have to be elegant; they just have to stand up. And so far, 30 years into the great China experiment, the elites are confident that the grafting of capitalism onto a state-controlled economy, overseen by a government controlled by a Communist Party, is standing up.

The headquarters building of the China Academy of Engineering is a testament to the nation’s growing ability to create elegant structures. Light spilled in through a large glass wall. The green building was paved with recycled marble tiles and boasts a sophisticated heating and cooling system that relies on recirculating water from deep in the ground. In a large reception area, whose centerpiece was a glass case filled with trains and planes, we met Xu Kuangdi, a veteran apparatchik, engineer, manager, and leader. Xu, an academic who served as mayor of Shanghai from 1995 through 2001, is vice chairman of the National Committee of the Chinese People’s Political Consultative Conference and president of the Chinese Academy of Engineering Sciences. And while the format of the meeting was old-school—we sat in large, comfortable chairs in a setting more like an audience than interview—there were several times during the meeting when I felt as if I were on the set of CNBC’s Kudlow & Co. For the only class struggle this veteran Communist discussed was the struggle of the newly rich to hold onto their gains.

Xu boasted China’s engineering triumphs: the 88-story building in Shanghai, designed by an American architectural firm but built by Chinese engineers; the 67 bridges over the Yangtze River; the Olympic structures; high-speed rail; supercomputers. And when we asked how we would square the experience of modern China—parts of Beijing are a luxury retailer’s paradise—with Communist Party doctrine, he had a ready response. Karl who? “We’re not a bookish party,” he said. Besides, the Communist Party has always been flexible when it comes to dealing with national priorities. It cooperated with the Kuomintang to fight the Japanese. “Mr. Marx is still widely respected by the party and the party members. He’s a great mind in the people’s history.” Just because many of his ideas are outdated—they were devised in a period without today’s developments in science and technology—it doesn’t means he’s forgotten. “I want to compare it to God in your mind. Maybe you don’t go to church every week. But that doesn’t follow that God is not in your heart.” Marxism, like religion, is “still a power that controls the morality of the people.”

Of course, in China, Marxist morality shifts over time. And today, the most moral thing that Chinese policies and people can do is promote economic growth and development, regardless of the distributional outcomes. In our time in China, we heard several reasons why the massive country simply couldn’t adopt Western-style democracy. The population is too large and too diverse. Democracy promotes the sort of arguing that hinders growth. The performance of other Asian countries seemed to have suffered when fractious democracies emerged from authoritarian or military rule. Xu added a new one: It would promote unhealthy class warfare. If elections were to be held in a large geographical area where gaps between the rich and poor are wide, and in which people have different educational backgrounds, “it might cause turbulences to society,” he said. “If somebody just went out in the street and shouted, ‘I will divide the property of rich people into poor people,’ I think he would be elected. But it is useless, as parity will not solve the problem of economic development.” Yes, the creation of wealth in China has been wildly uneven. But this, too, is consistent with the party’s goals, doctrine, and history, according to Xu. “Sometimes when we have the faith we have to take different approaches to realize our beliefs. The ultimate goal is the common prosperity, but we have to let a group of people to get rich first.”

http://www.newsweek.com/id/224340

November 30th, 2009 at 10:46 pm

This is a really excellent post, Allen. There are only few people who can wrap their brains around this issue, and I am glad you did and for articulating it for us.

December 1st, 2009 at 3:24 am

@24 wuming,

I absolutely agree with you.

Concerning the financial industry I would even see it worse: Since one decade investment companies cannibalize healthy firms by just removing their long term research etc. investments. There is not only no benefit to real economy but rather a severe damage. In parallel we observe the rise of top manager salaries, which could be read as successful bribing. Both effects swapped over the Atlantic to Europe, and I can only hope that at some time, European governments stop that “locust-swarm” development as well as remove the tax-limitation for high salaries.

Now, if China goes a different way by keeping control over the financial industry, – the exchange range is one part of it, I would read that as self protection.

December 1st, 2009 at 5:53 am

Keith @ 26, “a horrible deal for America”

K-dog, you actually have a fan here. As a fellow American I absolutely agree with you that there’s a war. But it is not the Chinese – it is our own WASP homeboy CEOs, decision makers, political leaders who are shipping our jobs overseas (if they don’t go to China they’ll go somewhere else), creating conflict and sending the unemployed people to fight it, wrecking the foundation of our wealth for greed and self-enrichment.

Make no mistake about it Keith you are on the mark about China – exactely like you are supposed to. America’s elite has been declaring war against it’s poor, but we Americans are so brainwashed by our military-industrial-media-complex we are led to believe all this is somehow the fault of our “enemies” – enemies manufactured for the sole purpose of maintaining class structure and perpetuate the ruling class dominace over America’s permanent underclass.

December 1st, 2009 at 6:32 am

@Keith #20,

I actually do respect this sentiment. It is perfectly sensible if some Americans feel that globalization is a bad deal for them. It’s also perfectly sensible if some Americans feel that America would be stronger and more prosperous with less trade – and more protectionism.

However, even with this, I’d still argue that the value of China’s yuan is a boon to America. If China’s yuan is truly that much undervalued, consider it a free gift to the world. Imagine someone you were willing to hire to $10 / hour all of a suddenly tell you unilaterally that he is willing to work for just $8.

OK – maybe countries are different from people. When China’s yuan is valued too low, it is actually sucking away industries from developed worlds, making the developed world weaker and China stronger.

I don’t know if I quite buy this because I believe the currency deficit reflects a combination of America’s spending habits and capital flow to China as that economy develops – not the Yuan’s value. Changing China’s yuan would not change the currency deficit per se. It may affect the volume of trade or shift trade to other low cost centers in the world, but not the currency imbalance.

Shifting trade volumes would economically isolate China – or it would slow global trade in general. But in general China does not want to withdraw from global trade because it is dependent on continuous exchange with the developed world to buy much needed technology and expertise in developing its own economy.

I think globalization is a good deal to everyone. The West should enjoy’s China’s labor surplus as long as it exists. After that, hopefully other parts of the world would take China’s place. Even if no one else takes China’s place, then the West would still have benefited. Eventually, low tier manufacturing may make its way back to the developed world, but citizens of the developed world would have had plenty of time to adjust for that if that’s the way it going to happen.

For the time being, enjoy the interdependence: even as the West grows increasingly dependent on China, so is China on the West. This is an expected result of globalization. Interdependence should be leveraged as an asset. The West’s current economic problem does not lie in China (or interdependence on China), but in how it has allocated its resources (borrowing to build asset bubbles) in the past – and how it’s going to clean that up going forward.

December 2nd, 2009 at 8:13 pm

YO, C-Liu, I’m so glad you feel me dawg.

I remember watching a TV show about happiness once. In the show Denmark was revealed to be a very happy country. An explanations was that no matter what you do for a living you get paid about the same there. Turns out the people are all in it together and do work they like.

Life is never fair, there is no free lunch, but wild west policies which disenfranchise parts of society to enrich other parts is not a society where people are all in it together.

@Allen #30, I take issue with “globalization is a good deal to everyone”.

Its a slippery slope to claim unemployed people created by global outsourcing and in-sourcing (by uncontrolled immigration and immigration policies meant to keep down American wages to enrich WASP homeboy CEOs (H1-B programs and policies like it) can possibly be a good thing.

All the spreadsheets in the world can’t justify policies which pull people apart instead of bringing them together. Globalization is good for the bottom line of corporations as it rapes the planet of our resources and changes the climate, but individual people have their own bottom line. A single person is more alive and valuable than all the corporations put together.

If globalization is good for everyone, please let me know exactly how. I will visit the people living in tents and under our freeway overpasses. I’m sure the news will cheer them up.

December 2nd, 2009 at 8:21 pm

@k-dog #31,

Thanks for taking issue with me about “globalization is a good deal to everyone”. I may have typed too fast. By “everyone” in #30 I meant every country, not every individual. In fact in #30, I specifically wrote regarding globalization that “It is perfectly sensible if some Americans feel that globalization is a bad deal for them.”

The human cost of industrialization, economic development, globalization (in both China and U.S.) is very real – and I don’t mean to overlook them – but at the same time that also doesn’t mean industrialization, economic development, and globalization is per se bad for society. You’ve raised deep issues that I didn’t mean to get into!

December 2nd, 2009 at 8:46 pm

@Allen #32

I hear you Allen and accept the clarification.

December 8th, 2009 at 9:36 am

The idea of offshoring or outsourcing itself are either good or bad unless the net jobs replaced by the outsourcing are not offset by additional jobs created by the additional income. I am pretty sure that is the case for America.

Looking at the current situation with globalization, I think it just means that the spirit of Capitalism is alive and well. Sure, we can blame China for manipulating its currency all we want but by printing its own currency America is manipulating its own currency. If anything, the Western democracies should be very happy that the evil of Communism is finally conquered by Capitalism in the world’s biggest nation. This is the goal which conservatives from Western nations have been envisioning for decades ever since the cold war.

As for the real human cost of Globalization, there are two sides to this as well. There are certainly engineers and factory workers whose lives are severely affected by losing jobs in the US, but at the same time there are a lot more engineers and factory workers whose lives have changed for the better in China.

Americans in general have been taught not to rely on others (especially the government) and have always been preaching so to other nations as well. Competition creates opportunities and drives innovation. Socialistic policies result in inefficiencies and stifle innovation. Heck America doesn’t even have universal healthcare because many think that socialistic policies would dampen the capitalistic spirit in the US. Unless America as a whole changes its attitude, I think the current pace of decline will just continue until global wages equalize. At the end of the day, if the average Chinese can live on less than $200 USD a month and still save over 20% of their income, I am sure Americans can manage the same.

January 26th, 2010 at 1:06 pm

Michael Pettis

http://mpettis.com/2010/01/everyone-wants-to-talk-about-currencies/